FITCH SEES U.S. 2026 GOVT DEFICITS RISING TO 7.8% OF GDP

encryption_Prophet

Early project evaluation expert, creating Token models and governance structure scoring systems. Analyzing venture capital rounds and unlocking plans. Identifying next-generation infrastructure protocols and potential hundredfold opportunities.

encryption_Prophet

Global Liquidity rising - August 23rd ,

- Reward

- 9

- 5

- Repost

- Share

GateUser-a180694b :

:

Working is impossible, it's the road to wealth.View More

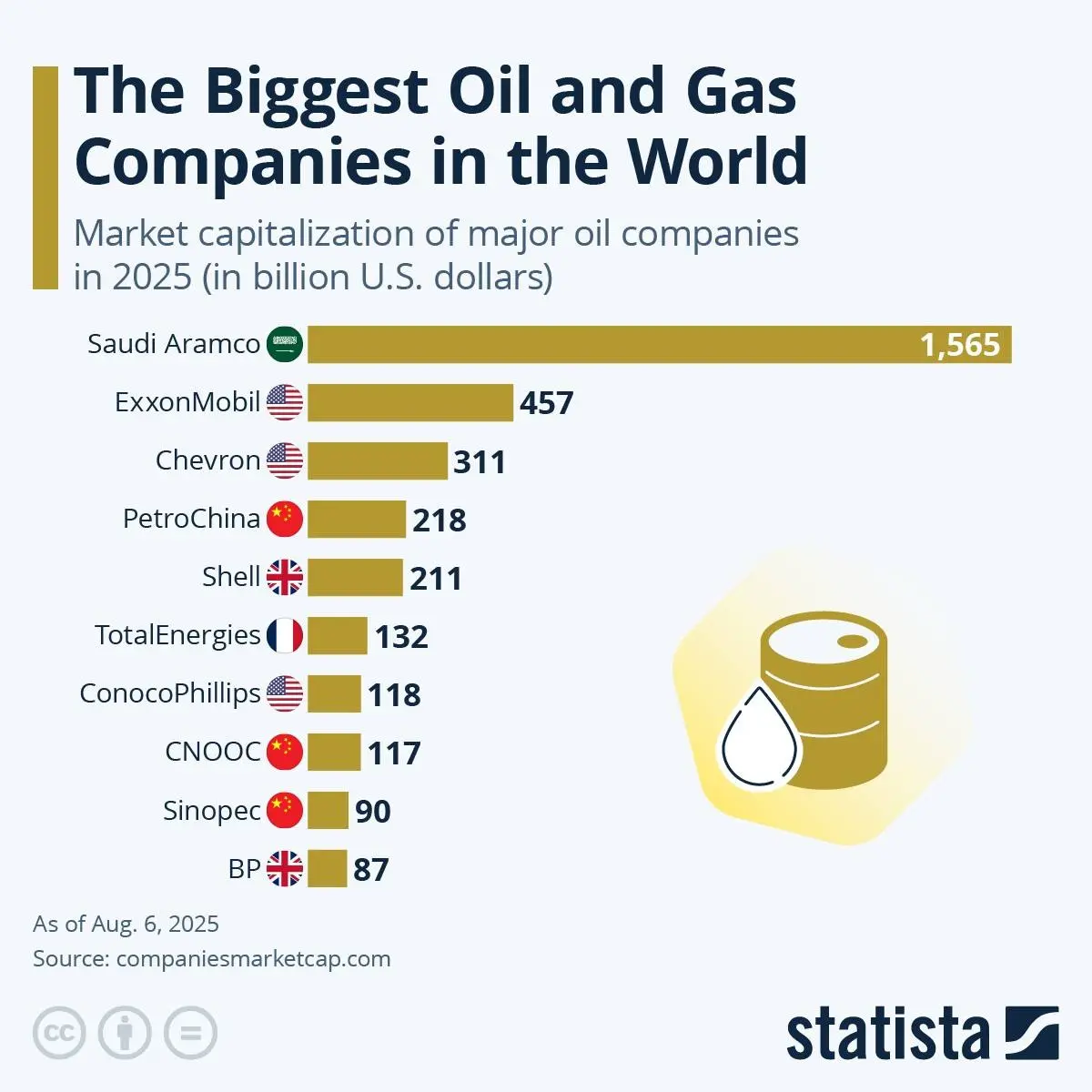

THE OIL KINGDOM: SAUDI ARAMCO CRUSHES COMPETITORS

Saudi Aramco is worth a mind-blowing $1.56 trillion, leaving every other oil giant looking tiny in comparison.

ExxonMobil comes in second with $457 billion, followed by Chevron at $311 billion, which still looks small.

China's

Saudi Aramco is worth a mind-blowing $1.56 trillion, leaving every other oil giant looking tiny in comparison.

ExxonMobil comes in second with $457 billion, followed by Chevron at $311 billion, which still looks small.

China's

- Reward

- 9

- 7

- Repost

- Share

DaoDeveloper :

:

insane market cap tbh... classic case of centralized economic primitivesView More

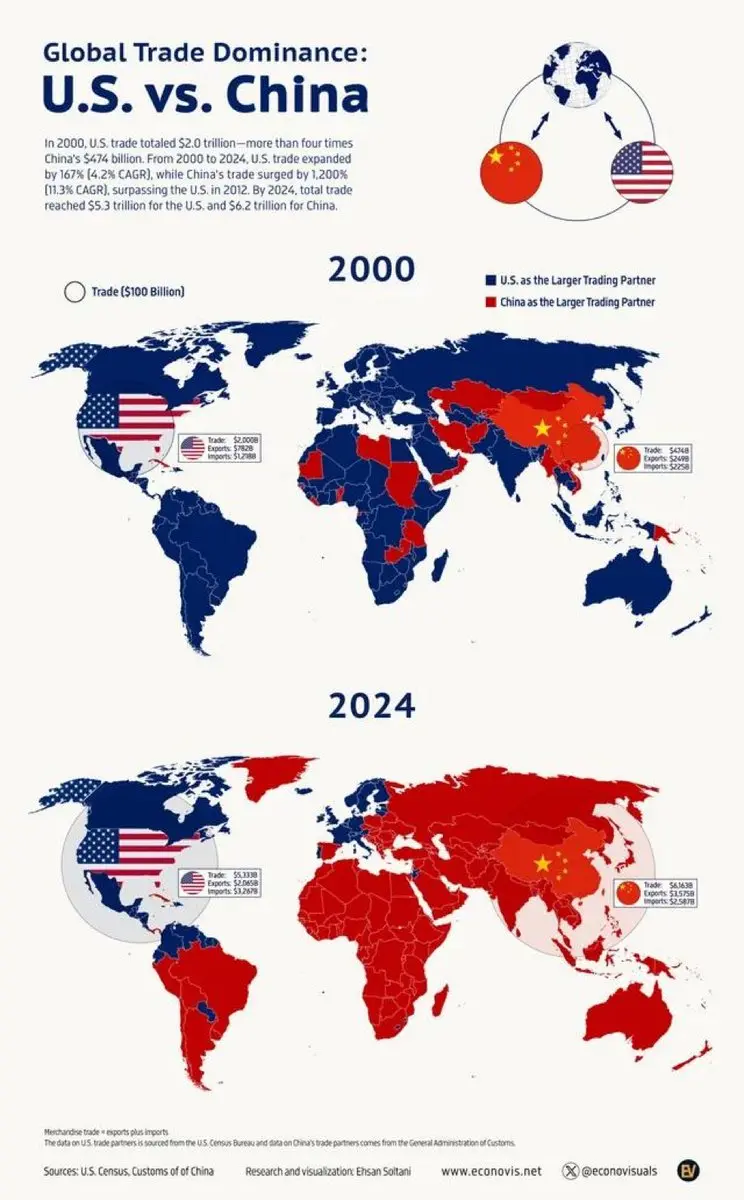

China's trade dominance cannot be denied. No amount of tariffs or threats to its trading partners can change that fact.

- Reward

- 9

- 7

- Repost

- Share

OnChain_Detective :

:

analyzing patterns here... china's 10yr trade flow metrics show undeniable dominance signature. tariffs = ineffective countermeasures tbhView More

- Reward

- 8

- 5

- Repost

- Share

WhaleWatcher :

:

This is the rhythm of collapse...View More

Fitch affirmed the United States' long-term foreign currency issuer default rating at "AA+" on Friday.

- Reward

- 12

- 4

- Repost

- Share

BankruptcyArtist :

:

I had a premonition of the downgrade... it's confirmed.View More

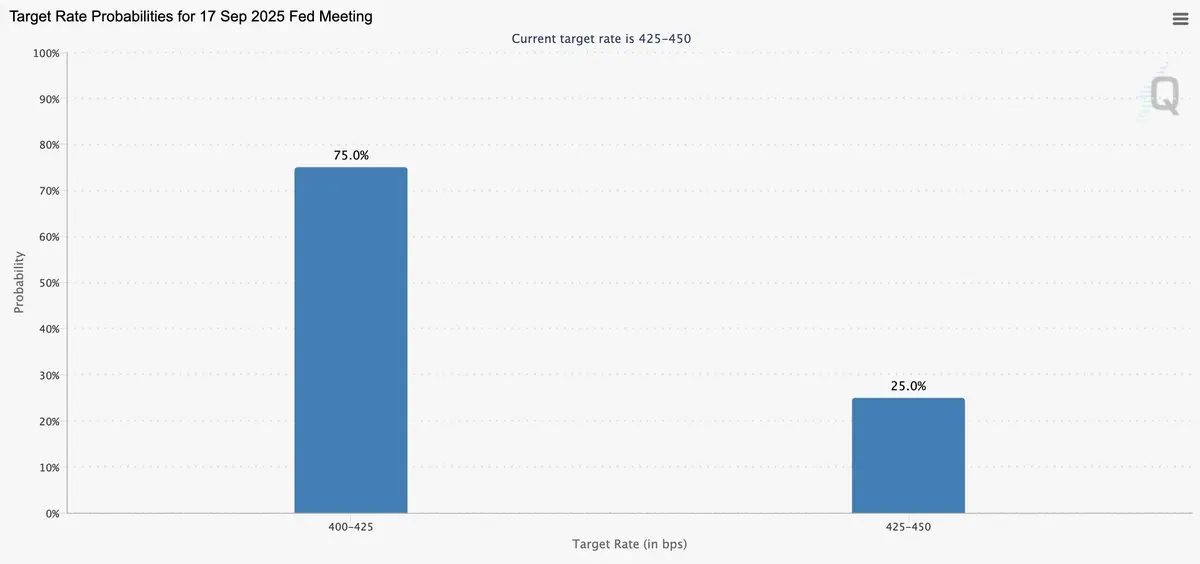

Fed Chair Powell has caved:

In 1 month, the Fed will CUT rates and blame a "weaker labor market."

Meanwhile, we now h…

In 1 month, the Fed will CUT rates and blame a "weaker labor market."

Meanwhile, we now h…

IN-5.62%

- Reward

- 16

- 5

- Repost

- Share

TopBuyerBottomSeller :

:

Either a bull run or a dead market!View More

Powell emphasized the importance of the labor market, and St. Louis Fed voting member Musser also stated that they would rely on the September non-farm payrolls and unemployment rate to determine the interest rate direction, creating a subtle game between rate cuts and recession expectations. If rate cuts are seen as favourable information, the market may restart its pump; if concerns about recession prevail, it may trigger further falls.

From the data perspective, a decrease in turnover rate over the weekend is normal, and short-term investors are trading relatively balanced, 112,000.

View OriginalFrom the data perspective, a decrease in turnover rate over the weekend is normal, and short-term investors are trading relatively balanced, 112,000.

- Reward

- 16

- 5

- Repost

- Share

MetadataExplorer :

:

Nothing much to see, just looking at the September data.View More

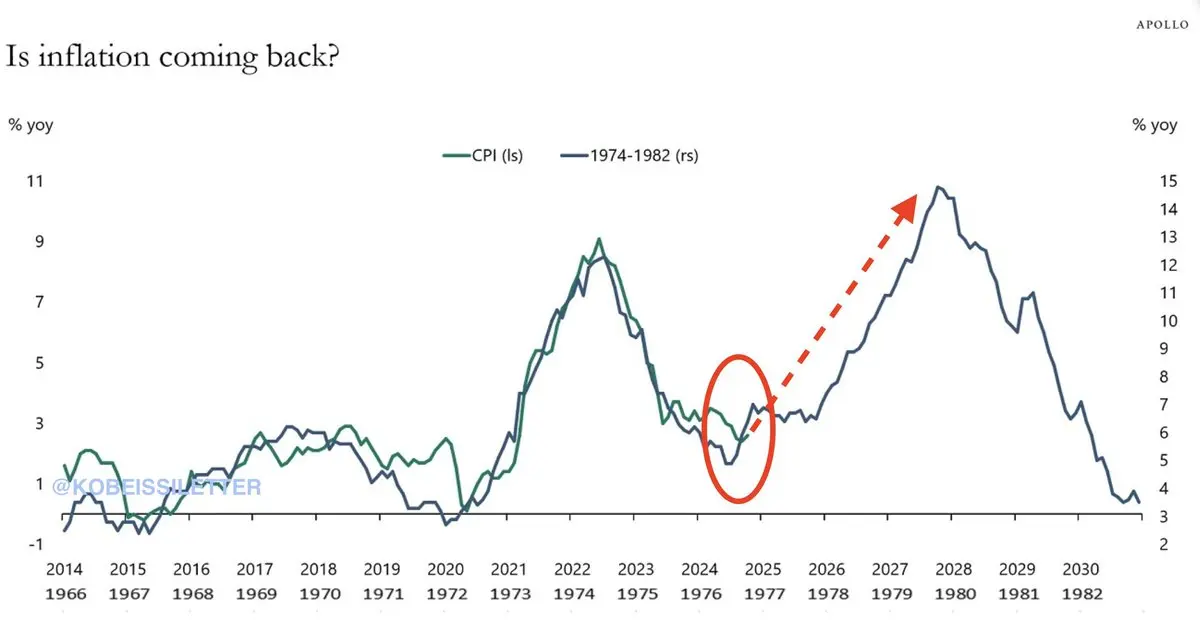

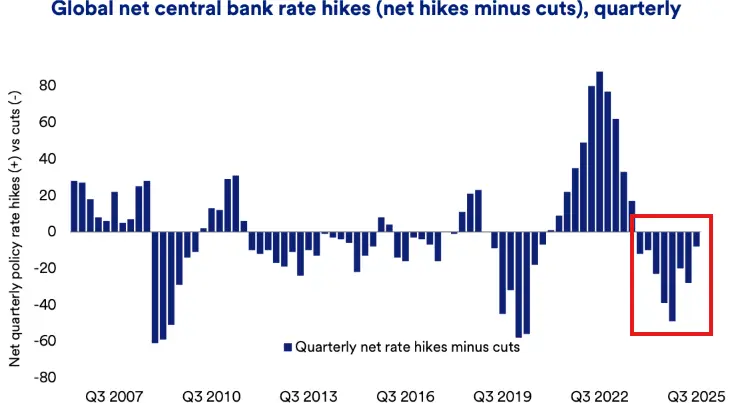

This trend will spread far beyond the US.

In fact, the Fed is actually "behind" on the current global rate cut cycle.

World central banks cut rates 15 times in May ALONE, the fastest monthly pace this year.

This also marks one of the largest waves of rate cuts this century.

In fact, the Fed is actually "behind" on the current global rate cut cycle.

World central banks cut rates 15 times in May ALONE, the fastest monthly pace this year.

This also marks one of the largest waves of rate cuts this century.

- Reward

- 9

- 4

- Repost

- Share

MemeCurator :

:

The entire financial world is starting to panic.View More

- Reward

- 10

- 4

- Repost

- Share

DeFiVeteran :

:

History is always remarkably similar.View More

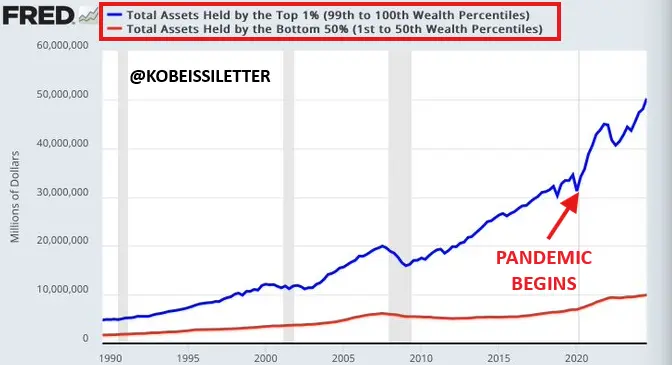

The result will be a continued historic widening of the wealth gap.

In the 1990 the wealth gap between the top 1% and the bottom 50% was $3 trillion.

Now the gap is $40 trillion.

The top 0.1% of Americans now hold 5.5 TIMES more wealth than the bottom 50% of Americans.

In the 1990 the wealth gap between the top 1% and the bottom 50% was $3 trillion.

Now the gap is $40 trillion.

The top 0.1% of Americans now hold 5.5 TIMES more wealth than the bottom 50% of Americans.

- Reward

- 17

- 8

- Repost

- Share

AllInAlice :

:

It's getting more and more outrageous. It can't really be changing dynasties, can it?View More

China's population

2024: 1.41 billion

2030: 1.39 billion (projected)

2024: 1.41 billion

2030: 1.39 billion (projected)

- Reward

- 15

- 4

- Repost

- Share

SmartContractPhobia :

:

The talent is running faster and faster.View More

- Reward

- 9

- 6

- Repost

- Share

GasFeeCryer :

:

The ball is finished, gas can be pumped again.View More

$X is worth 27.9 trillion USD

If we add up all the global assets

If we add up all the global assets

- Reward

- 7

- 5

- Repost

- Share

MelonField :

:

Why is all the money in the pockets of the rich globally?View More

- Reward

- 12

- 4

- Repost

- Share

PancakeFlippa :

:

What's the use of dry theory?View More

If you hold onto it, you will end up with nothing but a worthless piece of paper.

While the crash art tends to attract more attention, I want to continue investing steadily in quality risk assets while moderately inflating my BS.

View OriginalWhile the crash art tends to attract more attention, I want to continue investing steadily in quality risk assets while moderately inflating my BS.

- Reward

- 17

- 4

- Repost

- Share

P2ENotWorking :

:

If you're a warrior, choose a way to die! Holding it is just air.View More

I heard that JP Morgan's cash management volume is 10 trillion Dollar daily, and it blew my mind.

View Original- Reward

- 5

- 3

- Repost

- Share

MoodFollowsPrice :

:

The unscrupulous old banks are making a killing.View More

💥 BREAKING:

Rate cut odds are back at 75%!

Rate cut odds are back at 75%!

- Reward

- 9

- 3

- Repost

- Share

NullWhisperer :

:

technically risky odds, needs better validation criteriaView More

The Federal Reserve chair said that there are risks of both rising unemployment and stubbornly higher inflation.

- Reward

- 12

- 5

- Repost

- Share

WalletDoomsDay :

:

Unemployment and inflation are working together, right?View More